How To Change Billing Address For Debit Card

Applying for a DBS Debit Card or Credit Carte

Am I eligible for a debit menu?

Y'all must be at least 16 years of historic period. You simply demand a signature-operated DBS Savings Plus, DBS AutoSave or POSB Passbook Savings Account. To open one of these accounts click here.

If you are a foreigner, please apply for a debit carte at any of our branches. Y'all volition demand to nowadays your passport and an employment pass that is valid for at to the lowest degree 6 months.

Am I eligible for a credit card?

If yous're Singaporean or take permanent residency and you're over 21 years of age, you tin apply for a DBS Credit Card. Yous'll need to earn at least Due south$30,000 a year. For some cards, specially Platinum cards, you'll need to earn more than so check the Application Details for the carte du jour yous're interested in.

If you're a greenhorn with a valid employment pass, you'll need to earn a least South$45,000 a year unless otherwise stated.

What practise I need to apply?

The type of document you'll need varies. Click here for detailed list.

How long does it take?

Please let 7 working days for processing. Application not accompanied with required documents or with incomplete data will crusade a delay in processing.

Why was my application turned down?

All applications go through an approval procedure. For confidentiality reasons, we can't reveal why your particular awarding was unsuccessful.

However, we may not exist able to procedure your debit card application if your designated DBS savings or current account is not signature-operated, or if your signature differs from our records. In these instances, nosotros will notify you via an sms or alphabetic character and propose you to re-use at the branch or call us back for further verification

Can I check the status of my application?

Yep, Login to Net Banking. Go to Utilize > More than Application Services > Select "View Awarding Condition". Alternatively, you lot may conversation with our Virtual Assistant or Live Chat agents at dbs.com.sg/livechat. Please permit 7 working days for processing. Application non accompanied with required documents or with incomplete information will crusade a filibuster in processing.

Click Credit Card or Debit Bill of fare to select the card you wish to apply for.

Where tin I view the updated Credit Bill of fare and Unsecured Credit Rules?

Delight click here for the latest FAQs on Revised Credit Menu and Unsecured Credit Rules (ABS).

DBS Reward Points / DBS Online Rewards

What'southward DBS Rewards?

DBS Rewards is our way of proverb cheers for having a DBS Credit Card. Every time you accuse to your card, you earn DBS Points which you lot can use to exchange for a range of exciting advantage items.

How practice I qualify for DBS Points?

All DBS Credit Cardmembers are eligible for DBS Points Redemption Program. However, the Programme does not apply to the post-obit cards:-

- DBS Corporate Liability Card (MasterCard Corporate/ Executive and Visa Corporate/ Concern)

- DBS Purchasing Card

- Country Club Corporate Card

- DBS Alive Fresh Card

- DBS Takashimaya Card

- DBS Esso Card

- SAFRA DBS Credit/Debit Card

- POSB Credit Card

- DBS and POSB Debit Cards

How exercise I earn points?

You earn 1 DBS Betoken for every S$v retail buy charged to your DBS Credit Card. Points are calculated on each transaction and rounded down to the nearest whole number.

How do I earn accelerated points?

Some cards earn more than points than others. For example, with DBS Black Card yous'll earn two DBS points for every S$five retail purchase. DBS Distance Cardmembers earn iii DBS Points for every S$5 spent locally and earn 5 DBS Points for every S$five spent on overseas transactions. Local spend is identified as card transactions posted in Singapore dollars. Overseas spend is identified as card transactions posted in foreign currencies. Click here for full terms and conditions.

Are there whatsoever transactions that don't earn points?

DBS Points will not be awarded for:

- Pecker payments and all transactions via AXS, SAM, eNETS

- Payments to educational institutions

- Payment to government institutions and services (court cases, fines, bail and bonds, revenue enhancement payment, postal services, parking lots and garages, intra-authorities purchases and any other government services not classified here)

- Payment to insurance companies (sales, underwriting, and premiums)

- Payments to financial institutions (including banks and brokerages)

- Payment to non-turn a profit organisations

- Payments to hospitals

- Payments to utilities

- Betting (including lottery tickets, casino gaming fries, off-track betting, and wagers at race tracks) through whatever channel

- Any top-ups or payment of funds to payment service providers, prepaid cards and whatever prepaid accounts (including EZ-Link, NETS FlashPay, Razer Pay, ShopeePay, Singtel Dash and Transit Link)

- Instalment payment plan purchases, preferred payment plans, balance transfer, fund transfer, cash advances, annual fees, involvement, late payment charges, all fees charged past DBS, miscellaneous charges imposed past DBS (unless otherwise stated in writing past DBS).

What can I practice with my DBS points?

You lot tin can redeem them for a whole lot of great rewards. In that location's everything from dining vouchers to movie tickets, to domicile appliances. Click here to explore the whole range.

When do my points expire?

Your DBS Points will expire one yr from the quarterly period in which they were earned.

| DBS Points Earned Between | DBS Points Death Date |

|---|---|

| ane Jan - 31 Mar 2021 | 31 Mar 2022 |

| i April - 30 Jun 2021 | 30 Jun 2022 |

| ane Jul - 30 Sep 2021 | 30 Sep 2022 |

| 1 Oct - 31 Dec 2021 | 31 December 2022 |

Can Supplementary Cardmembers earn points?

Yep, these points will exist accumulated in the Principal Cardmember'due south account, and only the Principal Cardmember tin redeem DBS Points for Rewards. All the same, Supplementary Cardmembers may too utilise the Rewards Vouchers issued to the Principal Cardmember.

How do I know how many points I accept and how do I redeem them?

Your DBS Points appear on your monthly Credit Card statement. You may also log in to our online DBS Rewards redemption website or DBS PayLah! app to cheque your bachelor points and make a redemption.

When will I receive my voucher(s)?

Information technology volition have a few days to process your redemption and deliver the voucher(s). If you haven't received them after vii working days, please chat with our Virtual Assistant or Live Chat agent at dbs.com.sg/livechat.

Can I exchange vouchers or extend the decease date?

Deplorable, you lot can't abolish redemptions or exchange vouchers once you've requested them. The expiry is printed on the voucher, so use it, don't lose information technology!

Tin can I use my DBS Points to pay my Credit Card'south annual fee?

Yes, so long as redemption is done 1 calendar month before the Annual fee due date. Visit the fee waiver section of our Rewards page and select your carte du jour. Please note that the annual fee with be reflected in your Credit Card argument, upon its due date, but will be reversed in the post-obit month'due south statement.

How do I convert DBS Points to air miles?

For transfers to KrisFlyer, Asia Miles or Qantas Points, conversion charge per unit of ane DBS indicate to 2 miles applies and transfers are accepted in blocks of v,000 DBS Points (or ten,000 miles). For Air Asia BIG points, transfer is at the conversion rate of ane DBS Point to iii Air Asia BIG points and transfers are accepted in blocks of 500 DBS Points (or ane,500 Air Asia Large points). Each conversion of DBS Points to miles by Cardmember to his/her designated airline's programme volition be subjected to a S$26.75 administration fee (inclusive of GST). For Air Asia Large points conversion, the administrative fee is waived till 31 Dec 2022.

To redeem your DBS Points to miles, redemption can exist made through our Rewards website https://rewards.dbs.com. Please notation that the transfer process takes approximately ane - two weeks.

DBS Online Rewards

What is DBS Online Rewards?

DBS Online rewards website allows you to check your DBS points and redeem rewards online.

How do I login to redeem?

Simply enter your digibank user ID and Pin to login.

For Daily$ rebates, delight login to DBS iBanking to redeem your Daily$ rebates

I am non an existing DBS iBanking customer; tin can I yet redeem my points online?

No. You volition need to annals for a digibank user ID to perform DBS rewards redemption. Click here to register at present.

I am not a DBS Cardmember, tin I notwithstanding access the DBS Online Rewards website?

Yes. Y'all tin can still browse the website to assemble data. However, you need to be a DBS credit cardmember and digibank user to login. To sign up for a DBS credit card, delight visit www.dbs.com/sg/cards.

I accept more one DBS Credit Card. How can I redeem my DBS Points on this rewards site?

You tin login with your digibank user ID and Pivot. All DBS points accumulated via all your eligible credit cards will be automatically consolidated to your business relationship.

Can I change the billing address displayed in my account?

No. For security reasons, modify of billing address is not permitted via this site. Y'all may update your address via DBS iBanking or via our Accost/Telephone Number Update (Individuals) class

Are all my DBS Credit Cards eligible for redemption on this website?

All DBS reward point-earning credit cards are eligible for the redemption programme. DBS Corporate Liability Carte, DBS Purchasing Card, Land Club Corporate Bill of fare, DBS Alive Fresh Card, DBS Saab Credit Card, DBS Takashimaya Bill of fare, DBS Esso Card, SAFRA DBS Credit/Debit Carte du jour, POSB Credit Card and all DBS and POSB Debit Cards are non eligible for this DBS points reward redemption program.

How tin I view my DBS Points and expiry appointment?

After login, delight click on "My DBS Points Details" and all your DBS Points will be displayed with the corresponding expiry dates.

How do I search for rewards?

Please utilise the search bar below the menu. Yous tin can search for products by the following ways:

- Points range - drag the number

- Enter a keyword into the text box

- Select whatever one of the category on the bill of fare bar

How do I redeem for items?

- Elevate and driblet the detail into the shopping cart on the right, you may increment or subtract quantity by clicking on the + or - sign.

- Click on the product and a calorie-free box will open, enter desired quantity and click "Add together to cart"

How do I delete an detail from the shopping cart?

- Click on the - (minus) sign until it is removed from the shopping cart

- Become to "View shopping cart" and click on "Remove" to delete item

If I spend on my credit card now, how long does it take for me to be able to redeem on the points?

Your credit menu points will be updated once the merchant has posted the transactions and it will exist reflected in your account within 24 hours.

Paying Your Credit Card Remainder

What payment methods can I utilize?

There are plenty of options bachelor. Bank check the following table for details:

| Payment Channel | Payment credited on | Remarks |

|---|---|---|

| DBS Internet Cyberbanking/digibank | Payment is firsthand | For DBS/POSB account holders just |

| Phone Banking/ATM | Next working day (if payment is made before xi.30pm from Mon-Saturday, & before 8pm on the last working mean solar day of the month) | For DBS/POSB account holders only |

| SMS Banking Of import Notice: This service will be unavailable from 31 Oct 2021 | Next working day (if payment is made before eleven.30pm from Mon-Sat, & before 8pm on the last working solar day of the month) | Minimum/ Full payments can be made via SMS Banking after successful ane-fourth dimension registration |

| AXS Stations | Next working twenty-four hours (if payment is fabricated before 4.55pm on Weekdays). Payment made on Friday (afterward 4.55pm) and on weekends will exist credited to your Menu Business relationship on Tuesday (provided it is a working day). | - |

| Cash Payment at DBS/POSB branches | Next working day | - |

| InterBank GIRO | 3rd working day | Yous will need to complete GIRO application class |

How long practice I get interest-gratuitous on purchases?

You will have 25 interest-free days to make payment before your next Statement of Account is generated. Afterwards which, if you accept not fabricated full payment by the payment due date, you will be billed for interest, calculated daily from the date your transaction(s) were posted to your card account until full payment is received, subject to a minimum Southward$2.50.

Are there fees if I don't pay?

For partial payment or non-payment by the due date, at that place volition be Finance Charges computed at the prevailing interest charge per unit of 26.80% per annum levied. Finance charges are calculated daily from the date each transaction is posted to your card account until full payment is received. A minimum finance charge of Due south$2.fifty is applicable.

S$100 volition exist levied if minimum payment is not received on the menu account past payment due date, provided your outstanding balance is in a higher place S$200, with consequence from 27 April 2021.

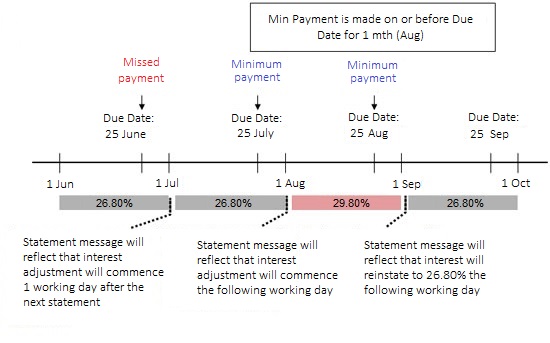

When will an interest adjustment be added to your account?

If the banking concern does not receive the required minimum payment past its due engagement (for example, due appointment on 25 June as illustrated in the example below), the interest charge per unit applicable to your Credit Card account volition exist increased by 3% p.a. on summit of the prevailing interest rate ("Increased Interest Rate"). This Increased Interest Rate shall exist applied to the outstanding residual in your Credit Card business relationship from the first working mean solar day later the appointment of the subsequent Credit Carte account argument following your Credit Bill of fare business relationship statement (i.e. from August's statement), and used to compute the finance charges applicable to your Credit Bill of fare account.

This additional involvement rate shall be practical even if minimum payment is received by the Bank on or earlier the due date of the following calendar month (i.e. in July).

In the outcome that the minimum payment is made in full on or before the due date for the next statement (for example for Baronial argument), the Increased Interest Rate shall be reinstated to the prevailing interest rate on the starting time working solar day after your next Argument Date (i.e. from September's statement).

Example:

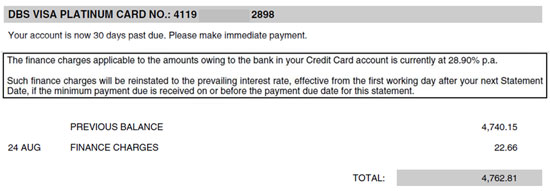

How do I know when the additional interest rate will be applied to my Credit Card Account?

Any adjustment/reinstatement to the prevailing interest rate will be reflected in your monthly statement nether your Account number.

Example:

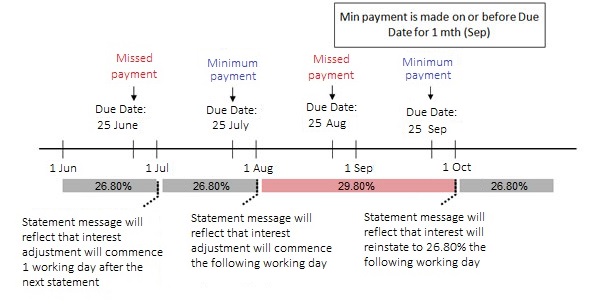

What will happen if I miss my payment again?

If y'all miss your payment again during the menstruation of the 1 calendar month during which you must maintain minimum payment in order for the Increased Interest Charge per unit to be reinstated to the prevailing involvement charge per unit, the Increased Interest Charge per unit will continue to utilize until minimum payment is made in full for one month period. Using the example above, the prevailing interest rate volition just exist reinstated from October's statement.

Example:

How can I avoid paying interest and fees?

- If yous pay your credit card balance in full each month past the due date.

- If you pay the minimum corporeality each calendar month past the due date, you can avoid belatedly payment charges.

Accuse Disputes

I can't think making a transaction. How do I check the full details of a charge on my statement?

Y'all may chat with our Virtual Banana or Live Chat amanuensis at dbs.com.sg/livechat or contact us at 1800 339 6963 or (65) 6339 6963 from overseas. We'll request a retrieval of the charge slip and mail it to you for verification. This may take from 6 to 8 weeks and costs S$5.00 per copy.

What if I'm sure I didn't make a transaction on my statement – or that it'due south for the wrong amount?

You may call our 24-hr Customer Service Heart at 1800 339 6963 or (65) 6339 6963 from overseas to register your dispute.

For FAQ, please click here for more infomation

Cancelling and Replacing Cards, Changing Your PIN

How do I cancel my card if it's lost or stolen?

If your debit or credit card is lost or stolen, you should report information technology immediately. We'll cancel it and arrange a new menu for y'all.

Once you report that your card is lost or stolen, you will not exist liable for any fraudulent transactions on your lost or stolen card from the time you notify us:

Visit our Cards Digital Services Page at go.dbs.com/sg-digitalservices to block and supplant your carte du jour. Alternatively, you may phone call our Customer Service Centre at 1800 339 6963 or (65) 6339 6963 from overseas.

What if I don't desire my Debit or Credit Carte any more?

Visit our Cards Digital Services Folio at go.dbs.com/sg-digitalservices to cancel your card. Alternatively, y'all may write in to us.

There'south no demand to give a reason simply please include your card account number & signature so we can abolish it. Our address is:

DBS Cards

Orchard Road

P.O. Box 360

Singapore 912312

For security reasons, please cutting each card in half and dispose of them straight away. If there are outstanding balances remaining, your monthly statement volition continue to be sent to you until total payment has been made.

I damaged my card, how exercise I get a replacement?

Visit our Cards Digital Services Folio at get.dbs.com/sg-digitalservices to replace your card. Alternatively, yous can call our 24-hour Customer Service Centre on 1800 111 1111 or (65) 6327 2265 from overseas to asking for a replacement carte du jour.

I can't remember my ATM/Debit/Credit Card PIN, can I request a new one?

If you've forgotten your ATM/Debit/Credit Carte Pin, you can reset instantly via:

- DBS/POSB Internet Banking:

Login to Cyberspace Banking >> Cards >> Reset Card Pivot - DBS/POSB Digibank app:

Login to Digibank App >> Bill of fare Services >> Reset Card Pin - If you do not have Net or Mobile Banking, you can reset here.

Upgrading or Irresolute Cards

How practise I upgrade? Can I become from Golden to Platinum?

Yes – as long as you lot stay with the aforementioned card. For case you can go from Visa to Visa Gilt or Visa Platinum. Just write to us. Include your card account number, signature and copies of your latest income documents (Income Tax Observe of Assessment, IR8A, a computerised payslip or employer'south alphabetic character). If it's canonical, your new carte du jour will be with you within 2 weeks.

Tin I modify to a different card?

Yes, but because each carte du jour has different terms you have to apply again. It's up to you whether y'all want to cancel your old card or keep it.

Cash Advance and Funds Transfer

How much does Cash Advance toll?

A Cash Advance fee of 8% of the corporeality withdrawn or S$15.00, whichever is greater, will be levied for each Cash Advance transaction made on your card account. In addition, Cash Advance prevailing interest charge per unit of 28% p.a. (field of study to compounding if the charges are not repaid in full) on the corporeality withdrawn, chargeable on a daily basis from the appointment of withdrawal until receipt of total payment (minimum charge of S$2.50) will utilize.

How does Funds Transfer piece of work and how to use for it?

With the DBS Funds Transfer Program, y'all tin transfer your balances from other banks' credit cards or lines of credit to your DBS credit menu.

To request a Funds Transfer, but consummate the Funds Transfer Grade. Impress it and postal service it to the states with copies of your other banks' statements if y'all're paying to other banks, such as Citibank, UOB, OCBC, etc. We'll permit you know the application status via mail service.

What happens to the Funds Transfer amount later on the promotional flow?

After the promotional menstruation, the normal involvement rate will apply. Click here to view the normal interest rate.

Enhancing Card Usage Security

-

What is EMV?

EMV stands for Europay, MasterCard, Visa which is a joint attempt to ensure security and global Interoperability so that MasterCard and Visa cards can continue to be accepted everywhere. With the EMV Smart Chip, your card is protected against fraudulent activities and you can savor the highest level of security when transacting on your Card. -

How does my EMV Chip Carte offer enhanced security against fraud?

The microprocessor chip on the EMV Flake Card is protected by cryptographic encryption, which prevents its contents from being replicated. The chip-based card complies with the MAS standards of data security. Magnetic stripe cards, on the other hand, apply an older engineering science making the bill of fare vulnerable to cloning. -

Tin I use my EMV Bit Carte overseas?

Yes, you may utilize your EMV Bit Card overseas. However, in some countries, EMV Chip Cards are not prevalent and not all terminals accept EMV Scrap Cards. In these countries, your transactions can withal be processed via the magnetic stripe. -

I take other master and or supplementary credit card(due south) with DBS. Volition these cards be replaced with EMV Scrap Cards likewise?

Yeah, nosotros are progressively sending out EMV Chip Cards to customers. -

What happens to my current Pin?

Your current PIN remains unchanged and will keep to apply to your new EMV Flake Card. -

Can I employ the EMV Chip Card for online transactions equally well every bit at ATMs?

Yeah, you tin use your EMV Flake Bill of fare for online purchases and perform greenbacks advances at ATMs. Yous may also perform greenbacks withdrawals at ATMs if yous take linked your DBS Current/Savings account to your Credit/Debit Card. -

What happens to my GIRO, installment payment program as well every bit recurring payment arrangements on my current bill of fare?

Your new EMV Scrap Card bears the same sixteen-digit credit carte number every bit your current Card. Hence, all these arrangements will remain unchanged. -

What happens to the DBS Reward Points / Dollars on my current bill of fare?

Your DBS Reward Points / Dollars will go along to remain in your account. -

Will the change in the expiry date of the card affect my online or ecommerce transaction(south)?

Yeah. Delight update your existing ecommerce merchants of the new expiry date of the card to ensure transactions are not affected. -

What should I practise if my EMV Chip Card has been misplaced?

Visit our Cards Digital Services Folio at become.dbs.com/sg-digitalservices to cake and replace your bill of fare. Alternatively, you may call our Customer Service Centre at 1800 111 1111 or (65) 6327 2265 from overseas.

Menu Activation

- Why do I need to activate my new DBS/POSB Cards before employ?

Banks are taking extra steps to protect their Cardholders to reduce the possibility of fraudulent transactions being undertaken by unauthorised parties. - Which types of Cards demand to be activated?

All new, replacement or renewal DBS/POSB Cards; principal and supplementary Cards, including DBS Commercial Cards, volition require activation. For Frequently Asked Questions on DBS Commercial Cards, please click here. - Where do I activate my DBS/POSB Carte?

You can activate your Carte du jour via any ane of the indicated channels:SMS to 77767:

- Activate <space> bill of fare'south final 4 digits.

- For foreign-registered mobile number, please use iBanking or DBS digibank app. Visit www.dbs.com.sg/act for more details.

Please note: Service is currently unavailable to Migrated debit and ATM cards, DBS Business organisation Advance Debit Cards and DBS Virtual Cards.

DBS digibank app:

- Login to DBS digibank app with your User ID and Password and Token

- Select "Carte Services"

- Select "Activate Credit Bill of fare or Actuate ATM/Debit Bill of fare"

- Follow instructions on the DBS digibank app screen to complete activation

Please note: You will need your Credit/Debit/ATM Bill of fare Pin which will be mailed to you for your ATM and PIN - based transaction.

iBanking (For iBanking users):

- Login to iBanking with your User ID and Countersign

- Under the "Cards" tab, select "Card Activation"

- Select either "Credit Bill of fare" or "Debit/ATM Card"

- Select the Carte du jour you would similar to activate

- Have the Terms and Weather condition and click "Side by side"

- Verify the details before clicking "Submit"

DBS/POSB ATM in Singapore:

- ATM activation is available from 7am - 11pm (Mon-Sat) and 7am - 9.30pm (Sun and Public Holidays)

- Insert your new Credit or Debit/ATM Carte

- Key in your Pivot

- Select "More Services"

- Select "Cards/PIN/iBanking/Phonebanking"

- Select "Activate Card"

- Follow instructions on the ATM screen to complete activation

- How can I actuate both my POSB Baby Bonus NETS carte du jour and POSBkids Business relationship in ane step?

CDA Customers tin actuate both your POSB Baby Bonus NETS Card and POSBkids Account instantly via the I-Step SMS Activation as below:- For Trustees who are existing DBS/POSB account holders:

SMS to 77767:

Actuate <space>bill of fare'southward last 4 digits <space> SG - For Trustees who are new to bank:

SMS to 77767:

Activate <space>card's concluding four digits <space> SG <infinite> SG

Please annotation: This service is only bachelor for Singaporean/PR Trustee & Child who are Singapore Tax Resident Only. By performing the 1-step SMS instant activation, you admit and concur that your child and you are revenue enhancement resident of Singapore only. - For Trustees who are existing DBS/POSB account holders:

- Can I use my Card immediately later on activation?

Activation via ATM and iBanking volition be immediate. For activation asking via Mail-in Activation Slip, your Card will be activated within 5 working days upon the Banking company's receipt of the slip. - Do I need to activate my DBS/POSB Card immediately?

Upon receipt of your Card, nosotros encourage immediate activation to ensure your transactions can occur smoothly so you can enjoy the privileges that comes with the Bill of fare.Important Notes:

For DBS Esso Platinum Card linked to Speedpass - Please activate the Card earlier paying with your Speedpass key tag at Esso service stations.

For DBS NUSS Platinum Credit Cards - Please activate the Card immediately to facilitate the debiting of the NUSS membership fee. - If I am waiting for a replacement Bill of fare with the same Menu number, tin can I continue to use my existing Card?

Yes, you tin can keep using your existing Menu. Upon receipt of the replacement Card, please actuate it immediately.Important Notes:

For DBS Esso Platinum Card linked to Speedpass - Please actuate your replacement/renewal Card before paying with your Speedpass key tag at Esso service stations.

For NUSS Platinum Credit Cards - Delight activate the Card immediately to facilitate the debiting of the NUSS membership fee. - Does a supplementary Card crave activation?

Yes. Supplementary Cards will also demand to exist activated by the supplementary Cardholder before use. - I am a principal Cardholder. Can I actuate the supplementary Card on behalf of the supplementary Cardholder?

No. Each Cardholder has to activate his or her own Bill of fare. - Can my supplementary Carte be activated before I activate my chief Card?

Yes, the supplementary Card tin be activated prior to the activation of the principal Carte du jour. - I am currently overseas. How can I activate my Credit Card?

Any one of the three means indicated can be used to actuate your Card from overseas:- iBanking

- If you have a Phone PIN, you may call our 24-hours Customer Service hotline at +65 6327 2265 and speak to one of our Client Service Officers

- Mail us the activation slip enclosed in the Card mailer

For Takashimaya Credit Cards but

- Will I be able to accumulate Takashimaya Bonus Points if my DBS Takashimaya Carte du jour is not activated?

You can only accumulate Takashimaya Bonus Points when your Card is activated. - Will I exist able to redeem my Takashimaya Bonus Points if my DBS Takashimaya Carte du jour is not activated?

You lot can only redeem your Takashimaya Bonus Points when your Card is activated. - If I replace my DBS Takashimaya Card with a new Card number, will my Takashimaya Bonus Points be transferred to the new Menu number automatically?

In the event that the Carte is replaced with a new Card number, Takashimaya Bonus Points will not exist transferred from former Card to new Bill of fare. - I received my renewed DBS Takashimaya Carte du jour. Do I need to redeem my Takashimaya Bonus Points stored in my old Card before using my renewed Card?

Yes, you will demand to redeem your Takashimaya Bonus Points stored in your old Carte, before:- the Card expires and

- activation of your renewal Bill of fare.

All points unredeemed in the old Card will be forfeited upon expiry date or upon activation of the renewal Card.

If nosotros oasis't answered your question here, visit our one-end guide for all your banking questions at dbs.com.sg/support or chat with our Virtual Banana or Live Chat agent at dbs.com.sg/livechat

Source: https://www.dbs.com.sg/personal/cards/cards-faqs.page

Posted by: kunkelwhaeld.blogspot.com

0 Response to "How To Change Billing Address For Debit Card"

Post a Comment